National scope. Local knowledge.

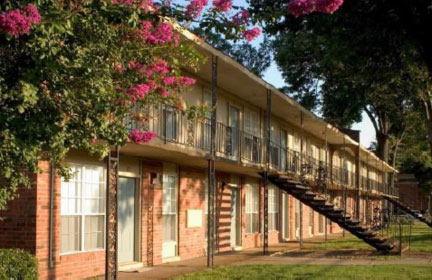

Harrison Creek Apartments

$3,237,480 Acquisition and Renovation Financing

Memphis, TN | January 2014

Thorofare Capital has provided a $3,237,480 senior secured loan for a Chicago-based sponsor to acquire, renovate, and lease-up The Villages at Harrison Creek. The sponsor purchased the 382-unit, two-story garden-style multifamily property for $4,400,000 and budgeted approximately $750,000 in planned renovations. The property consists of 41 buildings, a leasing office, two laundry buildings, and a free-standing maintenance shop situated on 13.2 acres. At the time of closing, the property was approximately 70% occupied.

The previous owner acquired the property in 2004 and borrowed $7,200,000 in order to renovate the asset. The absentee owner caused the occupancy to drop 30% while collections plummeted. Subsequently, the lender foreclosed and took title via auction at $3,800,000. The property has been lender owned since March 2011. Thorofare closed the transaction in just two weeks from application, allowing the sponsor to capture the acquisition opportunity in a competitive bidding process.

Thorofare’s financing structure included a capital improvement facility to advance against the renovation and unit turnover costs as well as a payment reserve that burns off once certain net operating revenue milestones are achieved by the property. Short-term yield maintenance requirements allow the sponsor to refinance the property with permanent financing in less than one year to maximize net cash flow after debt service.